FAQs

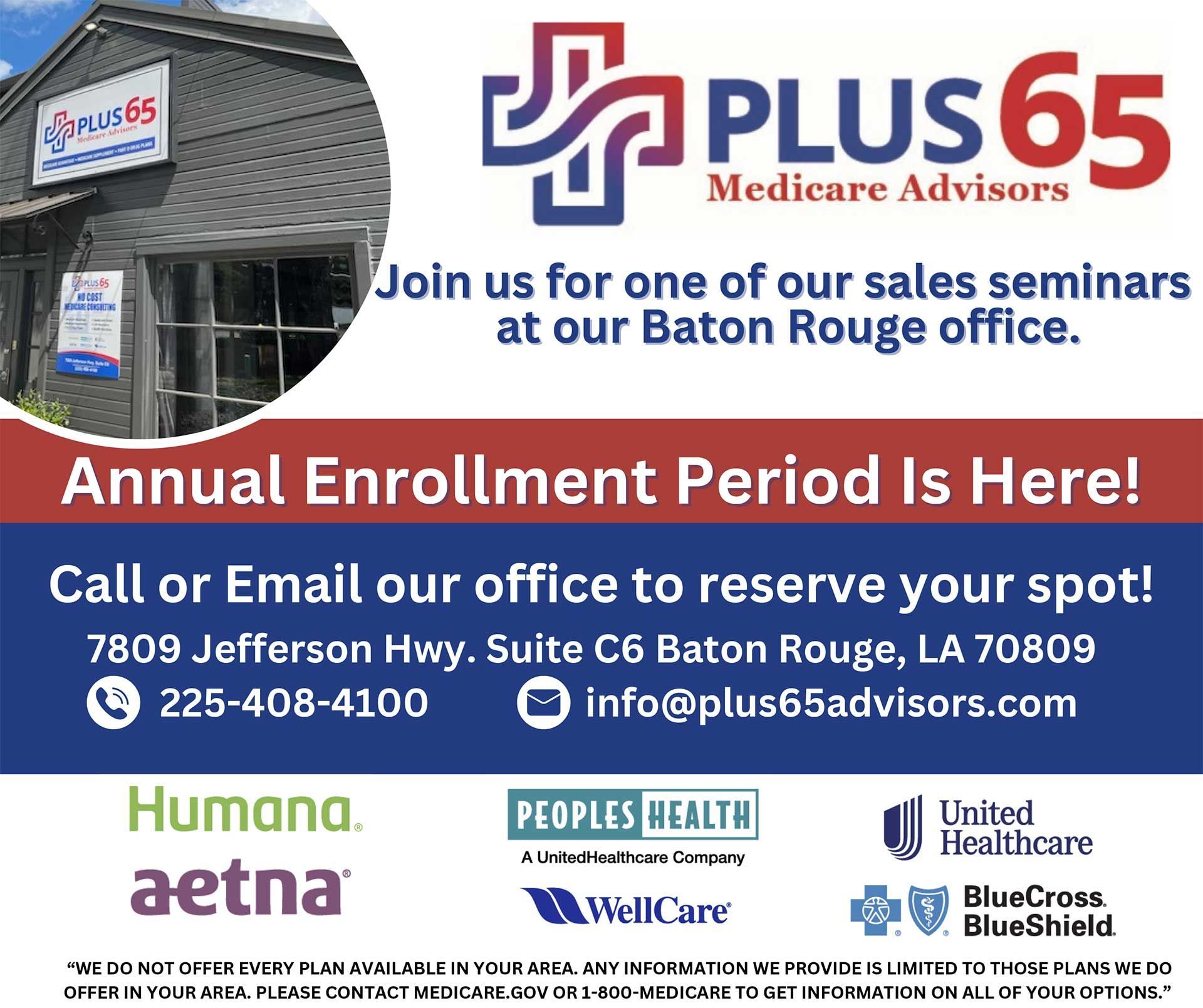

Plus 65 Medicare Advisors

Have a Medicare-related question? We have the answer! Check out our FAQs below to learn more about our company and services.

-

What is an independent Medicare agent?

An independent Medicare agent is a professional who assists individuals in selecting Medicare plans and services. Unlike agents who work exclusively for a single insurance company, independent Medicare agents represent multiple insurance carriers. This allows us to offer a variety of plan options and help clients find the coverage that best suits their needs and preferences. Get in touch with our team at Plus 65 Medicare Advisors to learn about your options for Medicare insurance in Baton Rouge, LA.

-

How does an independent Medicare agent differ from a captive Medicare agent?

A captive Medicare agent works for a specific insurance company and can only sell that company’s plans for Medicare insurance in Baton Rouge, LA. An independent Medicare agent is not tied to any insurer and can offer products from various companies, providing a broader range of choices.

-

What are the benefits of using an independent Medicare agent?

When you choose to reach out to our team to learn about the top Medicare insurance in Baton Rouge, LA, you will gain these benefits:

- Wider Range of Options: We can present plans from multiple insurers, allowing you to compare a variety of options.

- Personalized Advice: We tailor recommendations based on your specific needs and preferences.

- No Extra Cost: Our services are free for you; we earn commissions from insurance companies.

- Objective Guidance: Since we represent multiple companies, our advice is not biased towards a single insurer.

- Ongoing Support: We offer ongoing support and are available to answer questions, resolve issues, and assist with plan changes or renewals as needed.

-

How are independent Medicare agents compensated?

Our services to you are free. Independent Medicare agents are compensated by the insurance companies. If you're interested in learning about the best Medicare insurance in Baton Rouge, LA, then make sure you give us a call!

-

What should I expect during a consultation with Plus 65 Medicare Advisors?

During the consultation, we will:

- Determine your Medicare status: Assist with your application for Parts A & B if you are new to Medicare.

- Assess Your Needs: Discuss your health needs and preferences.

- Present Options: Provide information on various Medicare plans and explain the differences.

- Compare Plans: Help you compare the pros and cons of different plans of Medicare insurance in Baton Rouge, LA.

- Assist with Enrollment: Guide you through the application process for the chosen plan.

-

Can an independent Medicare agent help me if I already have a Medicare plan?

Yes! We can review your current plan to ensure it still meets your needs. If a better option is available, we can help you switch plans. We can also assist with annual reviews during open enrollment periods of the top Medicare insurance in Baton Rouge, LA.

-

How often should I meet with my Medicare agent?

It is a good idea to review your Medicare plan annually, in our experience. According to Medicare.gov, the Open Enrollment Period is October 15 to December 7. This is the time to review your Medicare health or drug coverage and decide if you want to make changes. You might also consult your agent if you experience an issue with your current plan, experience significant changes in your health, or have other life events such as moving out of your plan service area. If you're wondering if you have the best Medicare insurance in Baton Rouge, LA, then give us a call!

-

Can an independent Medicare agent help with other types of insurance?

Yes, we can assist with other types of insurance, such as life, health, or long-term care insurance. It is a good idea to ask about our full range of services. We'll be here to help you choose the best Medicare insurance in Baton Rouge, LA.

-

What should I consider when choosing a Medicare plan?

Consider factors such as your health care needs, budget, preferred doctors, and any ongoing treatments. An independent Medicare agent can help you evaluate and compare your options based on these factors.

According to Forbes, as of April 2024, about 67.3 million U.S. adults are enrolled in Medicare coverage. Get the coverage you need today! Reach out to our team to choose your plan for Medicare insurance in Baton Rouge, LA.

-

How can I check if my preferred doctors and medications are covered by a plan?

Provider directories and formulary tools are available on carrier websites. By consulting with our team, we can help ensure that your preferred doctors and medications are covered by the plan you’re considering.

If you have any more specific questions or need further clarification about Medicare insurance in Baton Rouge, LA, feel free to ask!

Learn More About

Plus 65 Medicare Advisors

Located in Baton Rouge, LA, Plus 65 Medicare Advisors specializes in Medicare advice and planning, including for Medicare Advantage and Supplemental plans. Over 35 years of combined experience and advice. Fully licensed and Medicare-certified staff. Serving the area and nationwide. Request a call today.

Business Hours

- Mon - Fri

- -

- Sat - Sun

- Closed

Holidays May Affect These Hours - Call Us 24/7

Share On: